Why Choose Power BI for Financial Reporting?

In today’s fast-paced business environment, timely and accurate financial reporting is critical to making informed decisions. Financial data, when analyzed properly, can help companies assess performance, allocate resources, and drive growth. However, traditional financial reporting methods are often tedious, manual, and prone to errors. This is where Power BI, Microsoft’s leading business intelligence (BI) tool, comes in. With real-time data integration, advanced visualization, and deep analytics, Power BI transforms financial reporting into a dynamic, insightful, and streamlined process.

In this blog, we’ll explore why Power BI is the preferred choice for financial reporting and how it can revolutionize the way businesses handle their financial data.

Real-Time Financial Data Analysis

Power BI’s ability to integrate with multiple data sources in real time allows finance teams to gain instant insights. Whether it’s connecting to ERP systems, Excel spreadsheets, or even banking software, Power BI ensures that you always have up-to-date information at your fingertips. This real-time integration is critical for making quick, data-driven decisions, such as identifying financial trends, forecasting future cash flows, or monitoring expenses against budgets.

Key Benefit:

Real-time financial reporting allows businesses to react quickly to market changes, mitigating risks and optimizing performance.

Customizable Financial Dashboards

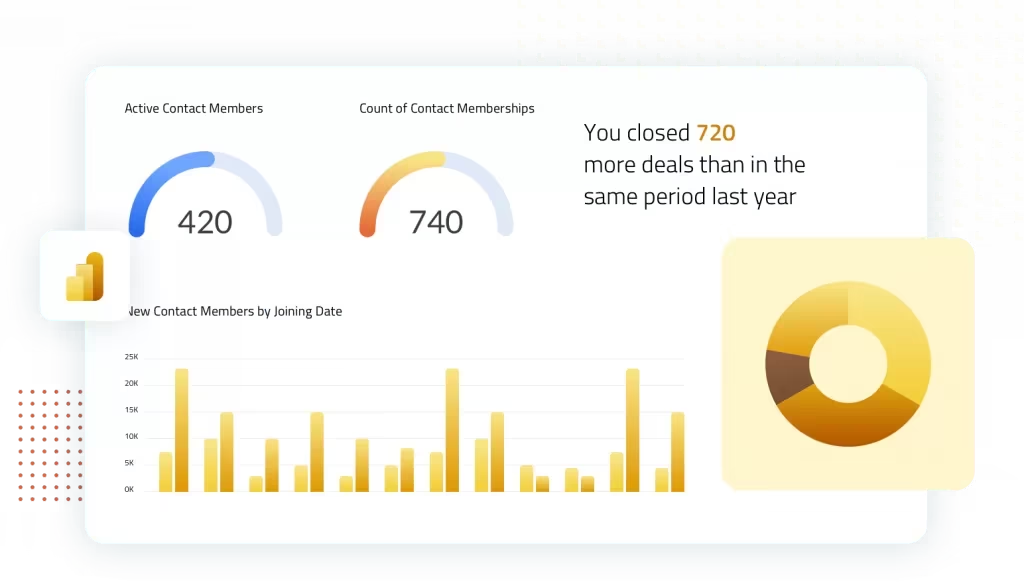

One of Power BI’s standout features is its ability to create customizable financial dashboards. These dashboards allow users to visualize key financial metrics such as revenue, profit margins, expenses, and cash flow in an intuitive and visually appealing format. Power BI’s drag-and-drop functionality makes it easy for finance teams to design and share interactive reports without needing any coding knowledge.

Key Benefit:

Custom dashboards help users tailor their financial reports to specific business needs, ensuring decision-makers see the data most relevant to them.

Advanced Data Visualization for Financial Insights

Financial reports are often filled with numbers, making it difficult for non-financial stakeholders to grasp the insights. Power BI solves this issue with advanced data visualizations such as charts, graphs, heat maps, and KPI gauges that simplify complex data. This means that instead of looking at rows of numbers, stakeholders can easily interpret trends and performance through visual aids.

Key Benefit:

Data visualizations make financial reports more understandable, fostering better communication between finance departments and other teams, such as marketing, sales, and operations.

Powerful Analytics and Predictive Insights

In addition to real-time data and beautiful visualizations, Power BI empowers financial teams to go beyond traditional reporting with advanced analytics. Power BI’s integration with Microsoft Azure and machine learning models allows businesses to perform predictive financial analysis, such as forecasting sales, predicting cash flow issues, or evaluating the financial impact of business decisions.

Key Benefit:

Predictive analytics enables finance professionals to foresee challenges and opportunities, allowing for proactive financial management.

Seamless Integration with Excel and Other Microsoft Tools

For many finance teams, Excel remains the go-to tool for financial analysis. Power BI enhances this by integrating seamlessly with Excel, allowing users to import, analyze, and visualize their Excel data within Power BI. This integration ensures a smooth transition from traditional financial models to more interactive, insightful reporting. Additionally, Power BI works with other Microsoft tools like Azure, Dynamics 365, and SharePoint, making it the ideal choice for businesses already using the Microsoft ecosystem.

Key Benefit:

Seamless integration with Excel and other Microsoft tools saves time and resources, providing a more efficient and cohesive financial reporting experience.

Scalability and Flexibility for Growing Businesses

Whether you’re a small business or a large enterprise, Power BI is designed to scale according to your needs. It supports both on-premise and cloud-based data sources, making it flexible enough for businesses at any stage of growth. As your financial data grows more complex, Power BI continues to deliver powerful insights without the need for significant IT infrastructure.

Key Benefit:

Power BI grows with your business, ensuring that your financial reporting capabilities evolve as your data needs expand.

Enhanced Security and Compliance for Financial Data

Financial data is sensitive and requires robust security measures. Power BI offers enterprise-grade data security features, including row-level security (RLS), data encryption, and compliance with industry regulations like GDPR. Finance teams can control access to specific data sets, ensuring that only authorized personnel can view confidential financial reports.

Key Benefit:

Strong security features protect financial data and help businesses comply with regulatory requirements.

Use Cases: How Power BI Transforms Financial Reporting

Cash Flow Management

Power BI allows businesses to track real-time cash flow metrics, visualize trends, and forecast future cash flows to avoid liquidity issues.

Budgeting and Forecasting

With Power BI’s predictive analytics, finance teams can create detailed budgets, compare them to actual results, and adjust forecasts accordingly.

Financial Performance Monitoring

Businesses can monitor KPIs such as gross margin, net profit, and operating expenses in real time, enabling better decision-making.

Frequently Asked Questions (FAQs)

1. Is Power BI suitable for small businesses looking to improve their financial reporting?

Yes, Power BI is highly scalable and affordable, making it an ideal choice for small to medium-sized businesses that want to improve their financial reporting capabilities.

2. Can Power BI integrate with my current accounting software?

Yes, Power BI integrates with a wide range of accounting software, including QuickBooks, Xero, and Tally, allowing you to visualize and analyze your financial data easily.

3. How secure is financial data in Power BI?

Power BI offers robust security features such as row-level security, data encryption, and multi-factor authentication, ensuring that your financial data is protected.

4. What kind of financial reports can I generate with Power BI?

With Power BI, you can create a wide variety of financial reports, including income statements, balance sheets, cash flow reports, and financial forecasts.

5. How long does it take to implement Power BI for financial reporting?

The implementation time depends on the complexity of your data environment. However, many businesses can have Power BI up and running within a few weeks.

Conclusion: Power BI is the Future of Financial Reporting

With its real-time analytics, advanced visualizations, and deep integration with Microsoft tools, Power BI is the go-to solution for modern financial reporting. It transforms static financial reports into dynamic dashboards that provide real-time insights, predictive analytics, and interactive data visualizations. Whether you’re a small business or an enterprise, Power BI helps you make more informed, data-driven financial decisions, leading to better performance and profitability.